Spring 2018 ASAM Newsletter

Click here to download a PDF version of the newsletter.

PRESIDENT’S CORNER

SUBExcel Report: Life Lessons from a Survivor of ‘Miracle on the Hudson’

“If you think you can’t, then you must.”

Since returning from Arizona last month for the ASA’s annual SUBExcel event, I’ve listened to these words play on “repeat” in my mind. This was the refrain of keynote speaker Dave Sanderson, the last passenger off US Airways Flight 1549, known to most as “The Miracle on the Hudson.”

Sanderson’s inspiring presentation recounted the details of a day that forever changed his life. He caught an early flight home from a business meeting, looking forward to seeing his wife and kids. But the universe had other plans for him. A flock of geese took out both engines, and now-famous pilot Chesley Sullenberger landed the Airbus 320 in the Hudson River.

Initially, Sanderson’s instinct was to exit the sinking aircraft through the fastest route. Then, he heard the words of his late mother, urging him to take care of others. He chose the impossible task—the right thing—and proceeded to help all the other passengers who needed assistance to make it out of the plane before exiting himself.

How often in our fields do we find ourselves facing what seems to be an impossible task? Do we choose self-preservation—either for our own careers or for our company? Do we seek the “fastest exit” at the expense of others? Or do we choose what’s right? For this reason—among many others—I’m proud to belong to the outstanding group of companies and individuals that comprise the ASAM. Our members are committed to doing what’s right for our industry; they’re dedicated to making it better for everyone.

Our chapter was well-represented at this year’s SUBExcel, and I’d like to extend my sincere appreciation to those of you who attended this educational event. I have no doubt that you will be bringing a plethora of industry wisdom and best practices back to share with your peers. Session topics were diverse, ranging from new strategies for fulfilling labor needs, lean construction, the importance of contract language, and more.

While at the event, members of our chapter spent time networking with chapters across the country. Our discussions revealed an opportunity for ASAM to strengthen one area of our mission—our commitment to legislative advocacy. We’d like to invite our local members to work more with state and local government to provide input on policy that impacts our industry. If this is of interest to you, please email me at weaverc@andeygan.com to learn how to get involved with our advocacy committee.

How to Stay Involved with ASAM

To stay involved with ASAM beyond legislative advocacy, watch our website (https://asamichigan.net/) for our programming schedule: General Membership Meetings feature presenters on topics that impact the construction industry. During our Construction Advancement Forums, a general contractor or construction manager shares details on their firm and how our members can better work with them. If you’re interested in learning from your peers, join us at our next Business Practice Interchange, where subcontractors tackle tough industry issues together.

All of our members’ voices are critical to moving our industry forward, so I encourage each of you to consider where your talents fit into our mission and join us at one or more of these events. And if you feel something holding you back, consider Sanderson’s advice: “If you think you can’t, then you must.”

Chris Weaver, Andy J. Egan Co., Inc.

ASAM President

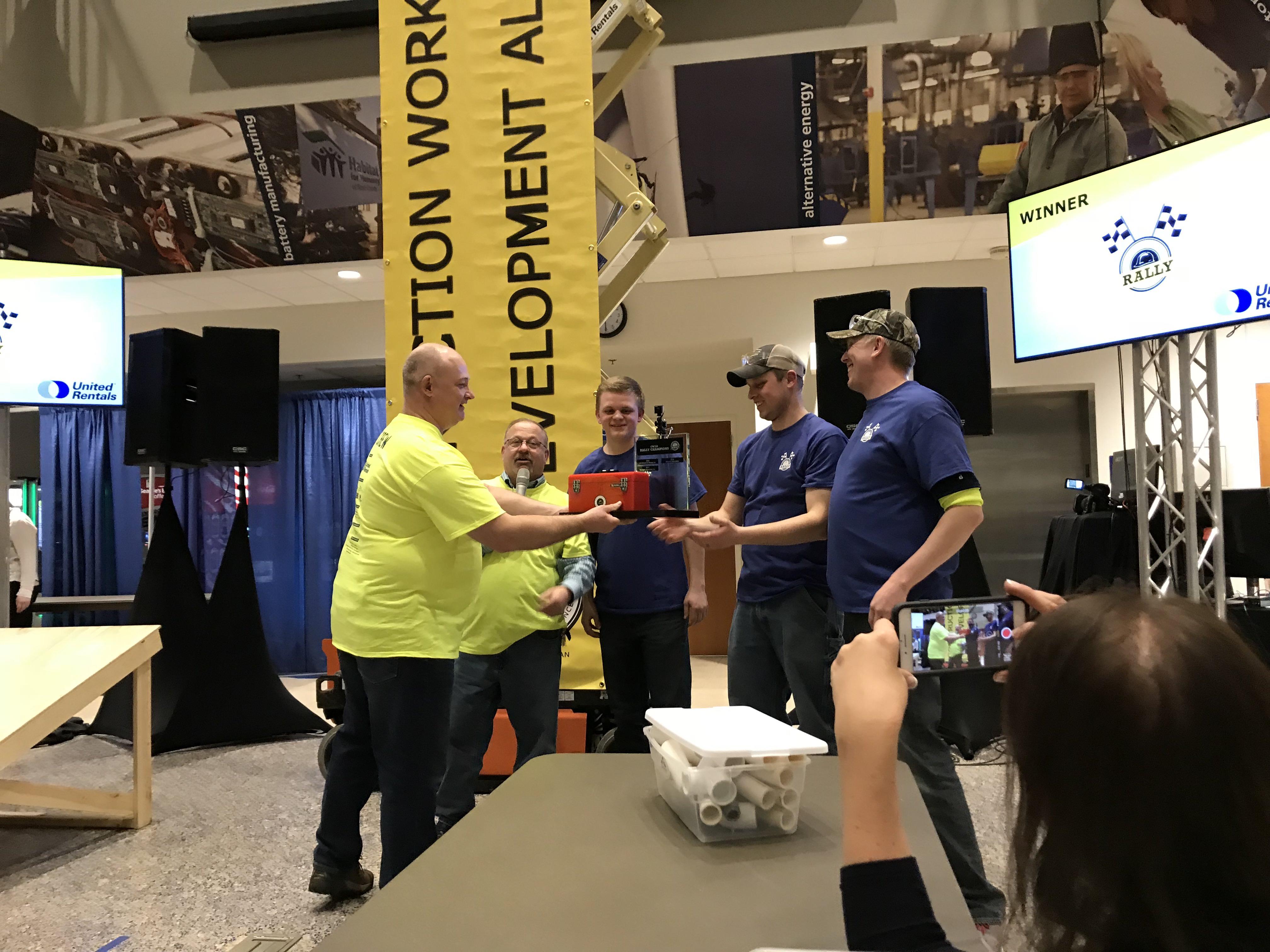

2018 CWDA Rally Celebrates Construction Industry while Raising Money and Awareness for Programs

On March 7, members of the subcontracting community enjoyed an evening of fun as they celebrated the construction industry while raising money and awareness for the Construction Workforce Development Alliance (CWDA), Construction Core Jump Start Scholarships and MiCareerQuest.

Congratulations to Team Dan Vos Construction for taking home the coveted trophy! And special thanks to United Rentals (championed by Dan Hall) as our title sponsor!

Commitment to growing and sustaining our industry in West Michigan is positively impacted with the funds raised at this key event. Each one of our sponsors and teams, as well as each ticket sold, impacts our construction community. Your investment will impact our futures and the lives of others by funding construction awareness, career education, trades training, camps and special projects. Every year we interact with more than 10,000 young folks! To find out more, visit www.webuildmi.com.

Lastly, here’s a shout-out to the 2018 pit crew who made up the crazy games, organized the night and made a positive impact:

- AJ Konynenbelt Zeeland Lumber & Supply

- Aubrey Meikle ABC Western Michigan

- Brent Balkema Journey Construction Group

- Chuck Lane, Van Dam Iron Works

- Dan Hall, United Rentals

- Jen Schottke ABC Western Michigan

- Jennifer Sanford, Ritsema Assoc.

- Jesse Snyder Alternative Mechanical

- Sarah Pfeiffle Reagan Marketing + Design/ASAM

- Steve Coates Welch Tile & Marble/ASAM

Captive Insurance: Do Changes to 2018 Corporate Tax Rates Impact the Viability of 831(b) Captive Insurance Programs?

The short answer to the question is: no. From the perspective of some people, the reduction in the corporate tax rate from the rate that existed in 2017 to the rates that will be applied in 2018 eliminates the incentives for captive insurance participants to elect 831(b) taxation. To some extent, that perspective is, unfortunately, understandable as many people view 831(b) captive insurance programs as purely a tax shelter. While there can be tax benefits to participating in captive insurance, the potentially more significant benefits lie in the ability to compress insurance premiums (i.e., pay less in insurance premiums); reduce risk by intentionally making risk management part of the corporate culture; and provide the opportunity for a corporation (or its key shareholders) to build long-term cash reserves which increase the value of the corporation.

Further, the taxation benefits of 831(b) election are not entirely eliminated by the 2018 reduction to corporate tax rates. In fact, one taxation benefit to 831(b) captive programs is the ability to outright eliminate the double taxation that exists for subchapter-C corporations. Another exists when the captive owners form an 831(b) captive with the goal of creating a long-term cash surplus as part of a succession plan. In that sense, ownership of the captive entity can be sold as part of a transaction in which the ownership of the entity for which the captive provides insurance. If that occurs, a sale of the ownership interests in the captive entity may be subject to tax treatment as capital gains, which avoids altogether the double taxation inherent in subchapter-C corporations and allows the selling shareholders to enjoy a long-term capital gain rate that will likely be much less than their ordinary income rate.

In short, the tax reductions being implemented this year have little to no effect on whether to form a captive insurance program or to do so by electing 831(b) taxation. The principal reason is that the benefits and concepts behind forming a captive insurance program are not hinged entirely on taxation benefits. Even when they are, a reduction to the corporate tax rates does not eliminate the issue of double taxation or recognize the difference between long-term capital gain rates and ordinary income rates. In conclusion, there are many ways to implement captive insurance programs into the risk management strategies of a company. People interested in how captive insurance could benefit their business enterprises should consult with attorneys, insurance brokers, and accountants who understand the intricacies of captive insurance.

Mark Rysberg, Hilger Hammond, ASAM Director

Job Site Training with MIOSHA Provides Valuable Worker Safety Information for Smaller Contractors

ASAM held its first safety alliance job site training with the Michigan Occupational Safety and Health Administration (MIOSHA) on February 21, 2018 at the Wolverine Dermatology building in Wyoming, hosted by First Companies, the general contractor.

“Definitely a great learning experience, not just for ASAM members, but for the general contractor as well,” said Brain Gall, ASAM Safety Committee Chair.

MIOSHA and ASAM formalized a mutual commitment to workplace safety and health by signing an alliance agreement this past fall. The goal of the alliance is to provide ASAM members with information, guidance, and access to training resources to help develop effective safety programs and to protect the health and safety of workers, particularly smaller contractors.

MIOSHA Construction Safety Consultant Phu Nguyen, CSP, conducted the training that included a group walkthrough at the job site, and discussion on how to identify hazards or potential hazards. Nguyen made recommendations for safe procedures and protections for the purpose of reducing accidents and injuries in the workplace.

Next Jobsite Training in June

The next safety alliance jobsite training with MIOSHA will be on June 5 and hosted by AJ Veneklasen. The training is free and open to all. No registration is required. For additional information on the ASAM Safety Committee and upcoming events, visit ASAMichigan.net/safety.